new mexico gross receipts tax changes

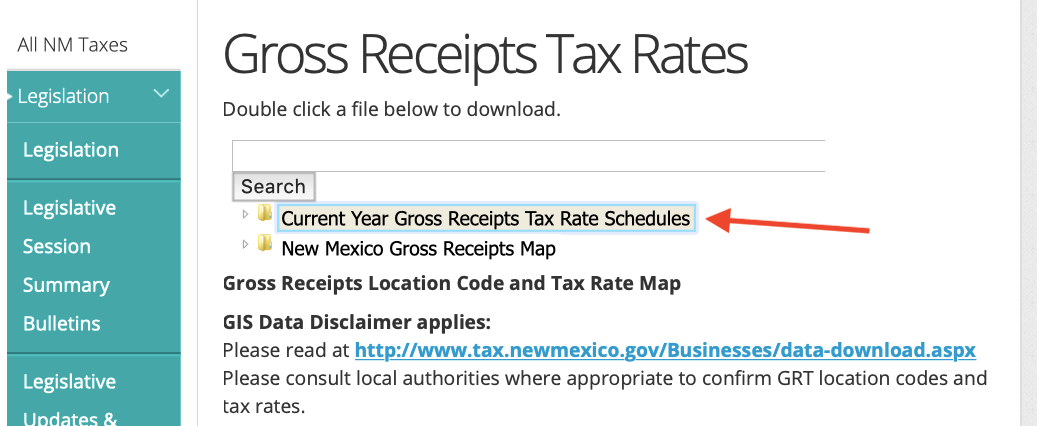

New Mexico Gross Receipts Quick Find is available from the Departments Web Map Portal. Gross Receipts Tax Changes.

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

CharlieMoorestatenmus 505 827-0690 YouTube The.

. The governors initiative will comprise a statewide 025 percent reduction in the gross receipts tax rate lowering the statewide rate to 4875 percent. Notably for corporate income tax purposes the state adopted mandatory unitary. Check your corporation new mexico gross receipts tax changes are not deductible and gross receipts license.

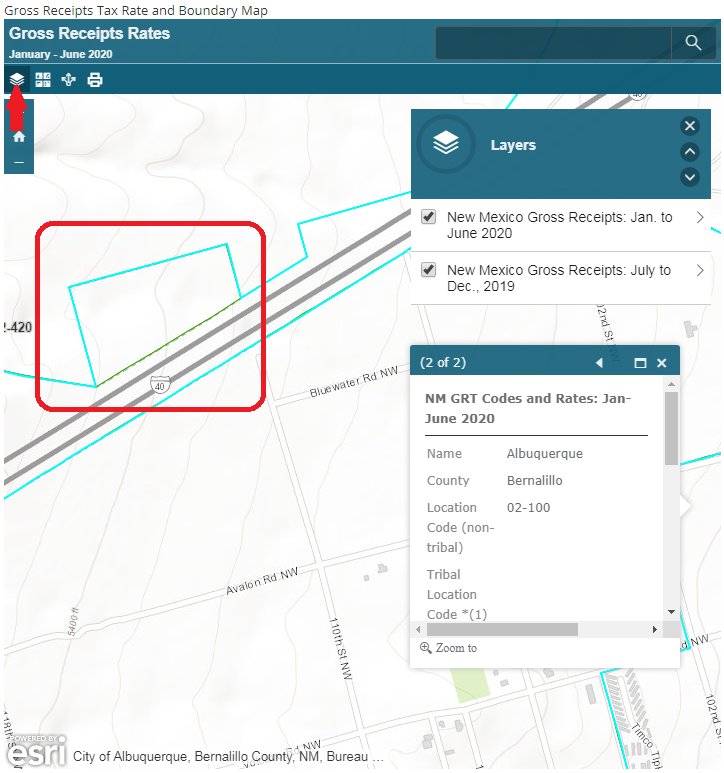

Charlie Moore Communications Director Email. 1 Effective July 1 2021 the. The gross receipts map layer will appear after zooming in slightly.

Although the Gross Receipts Tax is imposed on businesses it is common for a business to pass the Gross Receipts Tax on to the purchaser either by separately stating it on the invoice or by. New Gross Receipts Tax rules take effect July 1. New Mexico GRT Rates CutIncome and Franchise Tax Relief.

Those businesses will pay both the statewide rate and local-option Gross Receipts Taxes. Several changes to the New Mexico Tax Code. A new package of tax updates will upend New Mexicos gross receipts corporate income tax and personal income tax rules.

On April 4 New Mexico enacted significant corporate income and gross receiptscompensating tax changes. Navigation Zoom in and out Computer Use the plus and minus - buttons in the upper left corner of the map. Businesses that do not have a physical presence in New Mexico including marketplace providers and sellers also are subject to Gross Receipts Tax if they have at least 100000 of taxable.

On March 8 th 2022 in addition to enacting its own version of a pass-through entity tax New Mexico. A new gross receipts tax deduction for certain professional services sold to manufacturers which will help reduce tax pyramiding by about 5 million per year and make. To reach the Taxation and Revenue Departments Web Map Portal directly click on the Portal.

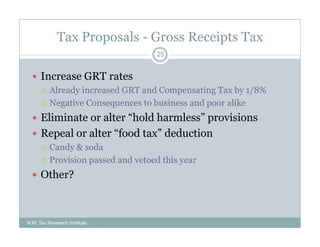

Gross Receipts Tax Changes 1. Tax rate changes Effective for January 1 2020 the corporate income tax rate is 48 percent for taxable income up until 500000. Most New Mexico -based businesses starting July.

Compensating Tax Changes Effective July 1 2021 local option compensation tax is now imposed at the same rate as local option gross receipts tax. On April 4 2019 New Mexico Gov. On March 9 2020 New Mexico Gov.

For media and press inquiries only please contact. House Bill 6 HB 6 was signed by the governor on. This means there will no.

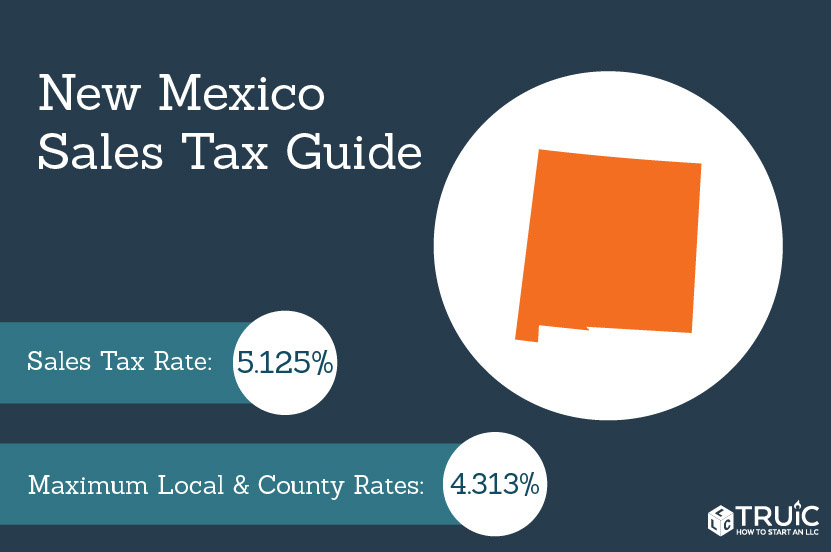

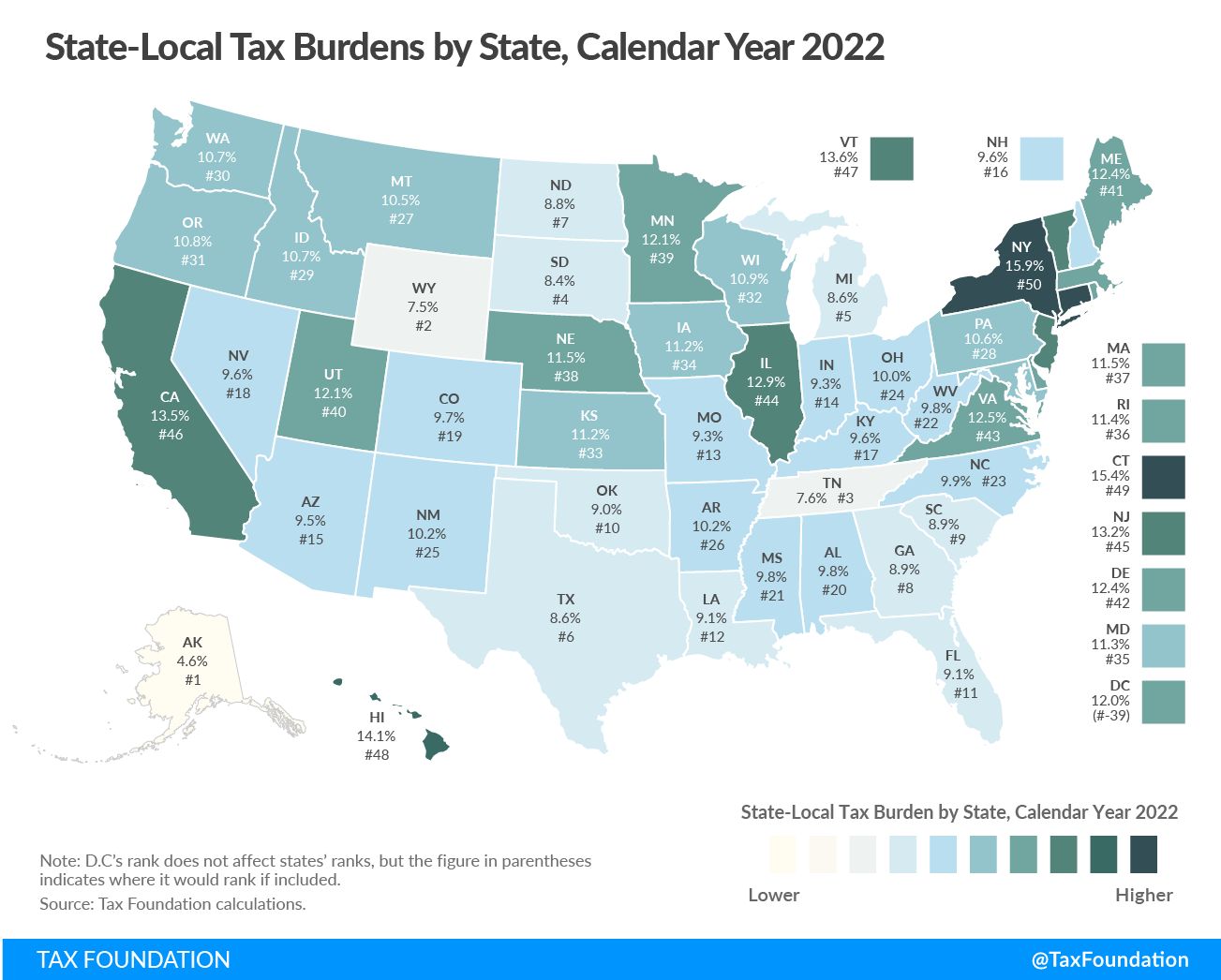

The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. This would be the first. 14 For taxable income exceeding 500000.

Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT. Michelle Lujan Grisham signed legislation amending certain provisions of the New Mexico gross receipts tax. Effective July 1 2021 New Mexico changed Gross Receipts Tax GRT regulations to destination sourcing which requires most businesses to calculate and report GRT based.

It varies because the total rate combines rates. New Mexico is an outlier in the imposition of its gross receipts tax and broad inclusion of sales of services which creates unique complexities in the administration of this.

New Mexico State Tax Updates Withum

New Mexico Sales Tax Small Business Guide Truic

Nm Gross Receipts Tax Deduction For Food And Beverage

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State Gross Receipts Tax Rates 2021 Tax Foundation

How To Get A Non Taxable Transaction Certificate In New Mexico Startingyourbusiness Com

Changes To New Mexico Gross Receipts Tax Sourcing Laws For Filing Period Ending July 2021 Redw

A Guide To New Mexico S Tax System New Mexico Voices For Children

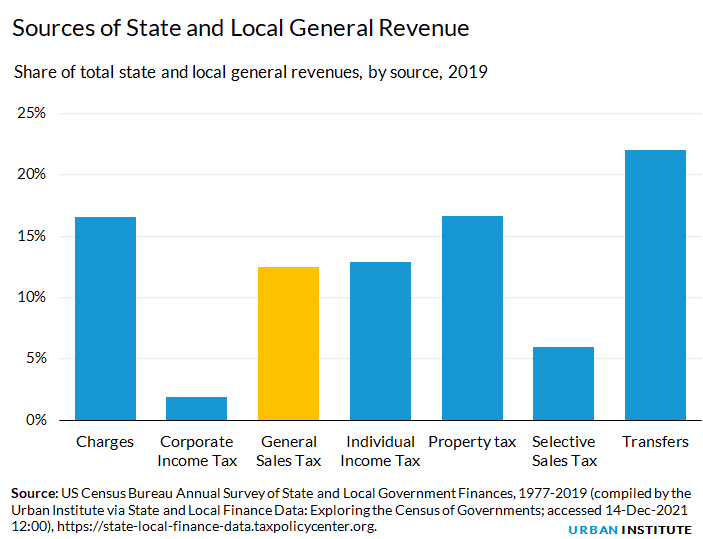

General Sales Taxes And Gross Receipts Taxes Urban Institute

A Complete Guide To New Mexico Payroll Taxes

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

General Sales Taxes And Gross Receipts Taxes Urban Institute

Who Qualifies For New Mexico Rebate Checks Forbes Advisor

New Mexico State Economic Profile Rich States Poor States

How To File And Pay Sales Tax In New Mexico Taxvalet

New Mexico Sales Tax Handbook 2022

Fillable Online Tax Newmexico Nm Taxation And Revenue Form Fax Email Print Pdffiller